Core Functions Adapted to Financial Scenarios

1. Dynamic Monitoring of Vehicle Assets

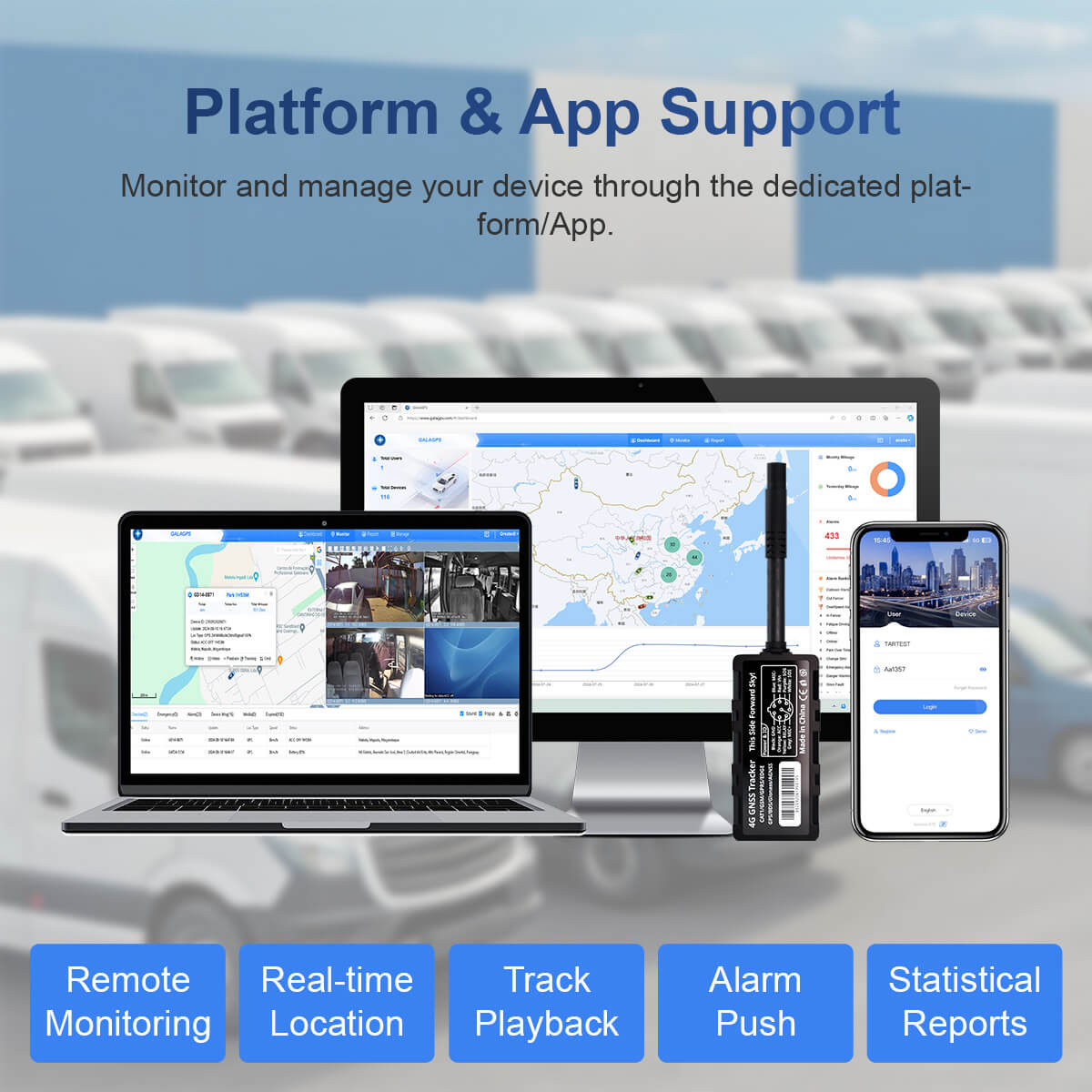

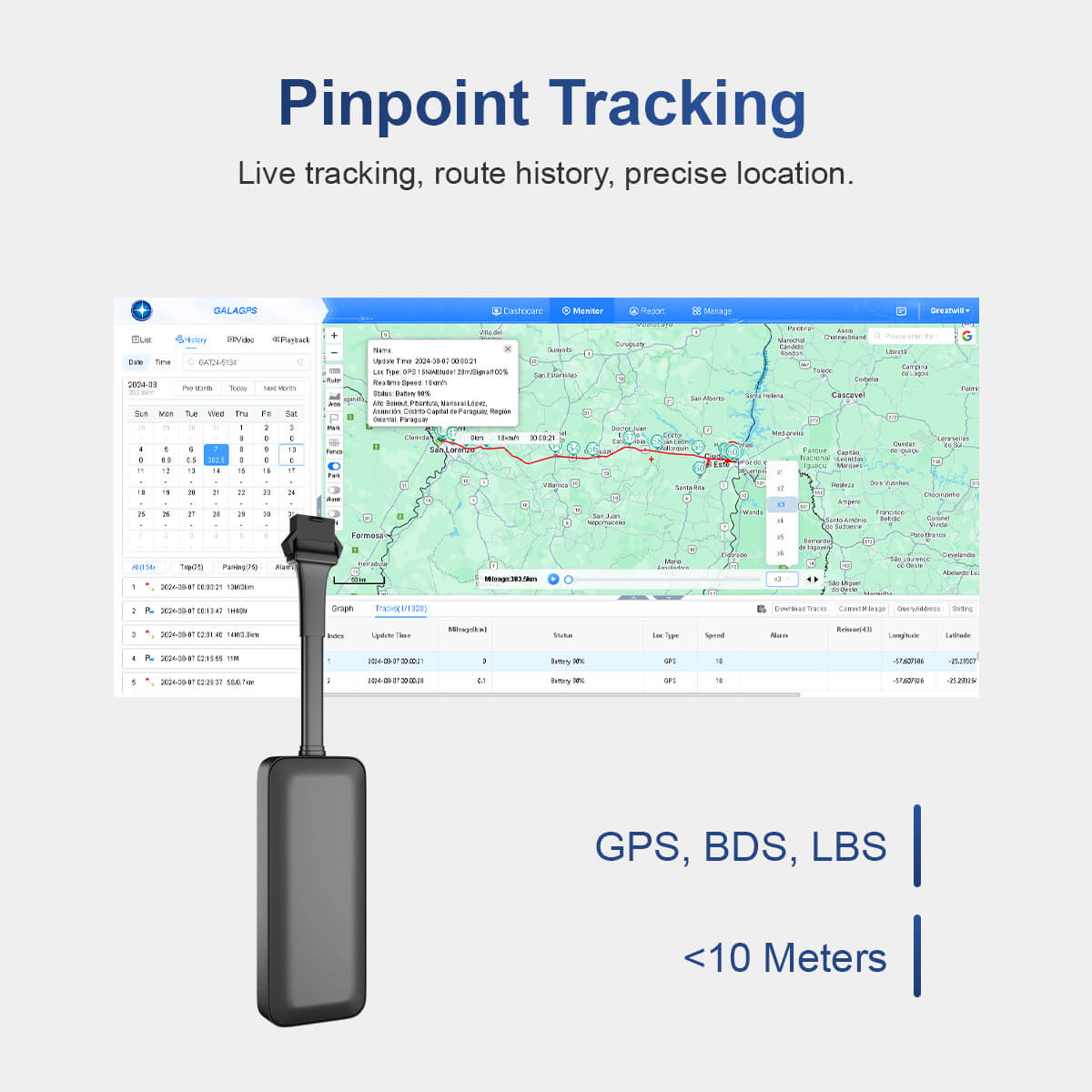

Real-time positioning and geofencing: Based on Beidou/GPS dual-mode positioning technology, the system can track vehicle positions in real-time and set up geofences to restrict driving areas. If a vehicle exits the authorized range (e.g., the usage area specified in the loan contract), the system immediately triggers an alarm and retains trajectory evidence, helping financial institutions quickly locate defaulting vehicles and reduce the risk of asset loss.

Trajectory replay and stay analysis: It supports historical trajectory storage for up to 3 years. Financial institutions can analyze vehicle usage patterns through trajectory replay, identify abnormal stays or frequent entry/exit into high-risk areas, and assist in judging whether borrowers have a tendency to default.

2. Multi-dimensional Risk Early Warning System

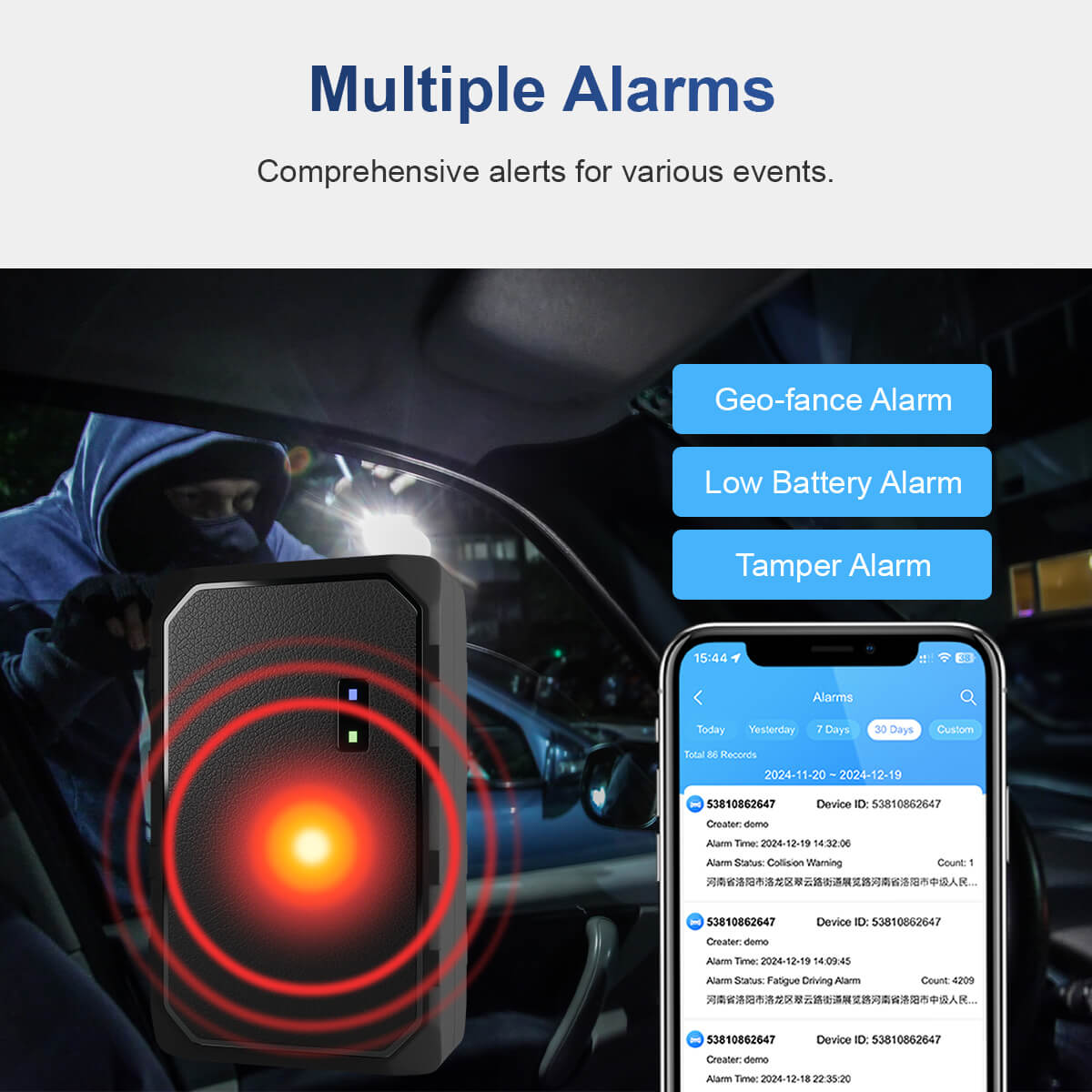

Car security gps tracker status and alarm linkage: The system can monitor issues such as vehicle GPS tracker device offline status, illegal tampering (e.g., GPS destruction), and abnormal fuel level fluctuations. Combined with rules for speeding alarms and illegal entry/exit alarms, it pushes early warning information to financial institutions in real-time, facilitating timely collection or legal measures.

Driving behavior and credit evaluation: Equipped with dashcams integrated with ADAS (Advanced Driver Assistance Systems) and DSM (Driver Status Monitoring), it analyzes high-risk driving behaviors like sudden acceleration and hard braking. Financial institutions can incorporate such data into borrowers' credit evaluation models to optimize pre-loan risk control and post-loan management.